It’s a joyous ritual almost as old as Singapore itself: A young couple get hitched, buy an HDB flat, renovate it, and then hold the formal wedding ceremony once the dream home is ready.

All heartwarming so far, but in one recent case, the happily-ever-after ended in the blink of an eye. The couple ended up fighting over their newly bought flat.

This young couple’s union lasted only three years before hitting the rocks, even before their customary wedding for relatives and friends. They had paid $370,000 for a resale Housing Board flat and spent close to $80,000 on renovations to create their matrimonial home. But things went downhill, and they separated before the five-year minimum occupancy period (MOP) was up.

The final straw likely came during the five-month renovation period when the couple actually lived in the flat while work was ongoing. Their stay was short-lived due to dust and noise. Instead of building a new home together, the flat became the focus of their divorce, as both wanted a bigger share of the asset.

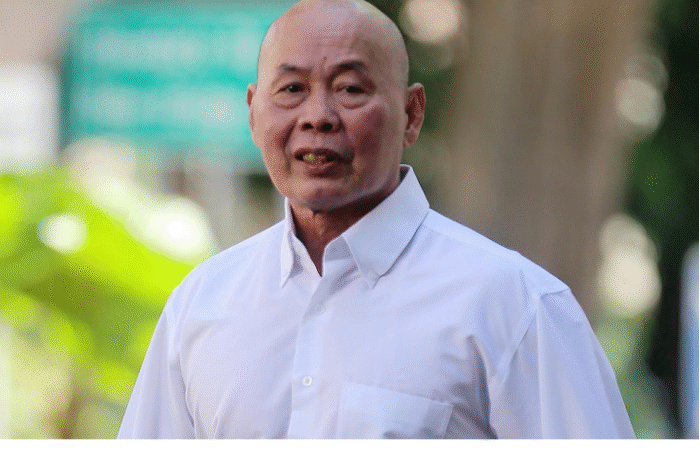

The flat was the only asset contested, as they had yet to formally live together as husband and wife in the eyes of their families and the law. When the case went before the High Court, Justice Choo Han Teck did not need to go through the usual steps of assessing incomes or considering indirect contributions to the marriage.

He noted that the couple had not undergone a customary wedding, “there was no consummation, and there were no children to take care of.” On the evidence, it seemed they were unable to get along from the start, and the marriage failed before it truly began. “I thus give no weight to indirect contributions,” he said.

Everything then came down to how much each had spent on the flat, which was bought using CPF savings and a loan. Without other compelling evidence, property shares are determined by the amount each joint owner contributed.

In this case, the woman contributed more to the purchase and paid most of the renovation costs. Justice Choo ruled she was entitled to 67 per cent of the flat, leaving 33 per cent to her ex-husband.

Direct contribution to property

Buying a home includes not only the purchase price but also other costs like stamp duties and legal fees. All such costs are considered when determining ownership shares.

But what about renovation funds? Here, the couple spent $76,000 on renovations in 2019 — $36,000 in cash and $40,000 through a bank renovation loan.

At the Family Court, the district judge excluded renovation costs, saying the improvements were basic and did not significantly alter the property. As a result, the couple’s shares were fixed at 41 per cent (husband) and 59 per cent (wife).

The wife, however, had paid the full $36,000 in cash, so her lawyer, Mr Sarbrinder Singh, appealed. Justice Choo allowed the appeal, ruling that direct contributions should include not only purchase costs but also expenses for improving the matrimonial asset. Renovation, he said, often involves substantial facelifts and customisation. With costs making up 20 per cent of the flat’s purchase price, “it would not be just and equitable for the court to ignore such sizeable sums.”

At the hearing, the man argued that he reimbursed his wife part of the renovation cost, first claiming $15,500, later $29,000. But he had no proof. Both the Family Court and Justice Choo rejected his claims, finding that the wife had paid the full $36,000 in cash. This amount was added to her direct contributions.

Dividing a couple’s assets

When couples split, the courts divide assets based on contributions — both financial and non-financial. For long marriages, indirect contributions like childcare and household management are weighed heavily, often resulting in equal division.

But in this case, the union ended before indirect contributions could even arise. Thus, division of the HDB flat was based solely on financial inputs.

The husband withdrew about $63,000 from his CPF account for the flat, while the wife used $91,000. Adding her $36,000 renovation payment, her total came to $127,000. The court ruled she was entitled to 67 per cent of the flat, with her ex-husband holding 33 per cent.

However, neither can claim their share yet because the flat cannot be sold until the MOP expires in August 2024.

The lesson from this case: when buying property, do not leave your co-owner to foot most of the bill. Every dollar counts, and contributing less will reduce your share when the home is eventually sold.